The entry of China Broadcasting Network into the mobile communication sector will further stimulate the 5G application market in our country.

With China Broadcasting Network launching its services today, what changes will occur in the mobile communication market has increasingly drawn the attention of the industry. In my opinion, when China Broadcasting Network enters the mobile communication market, the ones most threatened would be China Telecom and China Unicom, as they lack a well-covered 5G network.

I. network coverage is of great significance.

In the 2G era, China Mobile and China Unicom competed against each other. Although the tariffs of China Unicom were consistently lower than those of China Mobile, due to the fact that both China Unicom's CDMA and GSM networks failed to cover the entire country, poor signal quality became China Unicom's characteristic. From 2004 to 2008, the monthly net increase in users of China Mobile soared from 2 million to 7.97 million, while that of China Unicom was only 1.5 million. China Mobile and China Unicom achieved an absolute victory.

After entering the 3G era, China Telecom acquired the CDMA network of China Unicom. Within just 18 months, it successfully built a nationwide 3G network. China Mobile countered with 2G-EDGE, while China Unicom still failed to cover the entire country with both 2G and 3G networks. Eventually, China Mobile gained 300 million net new users, China Telecom achieved 158 million net new users, and China Unicom had only 149 million net new users. Surprisingly, China Telecom surpassed China Unicom in this competition.

After entering the 4G era, China Mobile had been holding its breath during the 3G era. Therefore, the construction of the 4G network was carried out at a rapid pace. In just one year, 700,000 4G base stations were built, and the 4G network quickly covered the entire country. China Telecom and China Unicom obtained a more advanced LTE-FDD technology. However, China Telecom released a portion of the 800 MHz frequency band for the construction of the LTE-FDD network, and its number of 4G base stations was higher than that of China Unicom. China Telecom quickly covered the entire country with the 4G network, while China Unicom still failed to have any network covering the entire country for 2G, 3G or 4G.

During the entire 4G era, China Mobile emerged as the clear winner, with an absolutely dominant number of 4G users. The number of 4G users of China Telecom was ahead of that of China Unicom, and even its overall user count surpassed that of China Unicom. Eventually, after the 3G era and the 4G era, China Unicom completely fell to the bottom among the three major operators, and it has always had a poor reputation for its weak signal.

From this, it can be seen that network coverage is indeed the lifeline for operators. Without a fully covered network, even the most intense price wars will not be able to win over users.

II. China Broadcasting Network may attempt to acquire users from China Unicom and China Telecom.

This time, China Broadcasting Network has jointly built and shared the 5G network with China Mobile. Leveraging the 700MHz golden frequency band owned by China Broadcasting Network, the industry generally believes that the 480,000 700MHz 5G base stations they have constructed are sufficient to cover the entire country. With the excellent coverage advantage of 700MHz, the 5G network will provide much better coverage for high-speed railways and expressways compared to 4G.

In contrast, previously, the three major operators had built approximately 1.2 million 5G base stations at a high frequency. China Unicom and China Telecom jointly built and shared a 5G network, so each 5G network actually had about 600,000 5G base stations. Moreover, this was in the high-frequency band. Meanwhile, China Telecom's 4G base stations reached over 1.3 million, among which some were 800 MHz 4G base stations. China Mobile had over 2.4 million 4G base stations. It can be seen that their previous 5G network coverage was extremely inadequate.

In general, China Unicom and China Broadcasting Network jointly built and shared a 5G network with China Mobile. As a result, they not only quickly obtained a fully covered 5G network, but also could utilize the well-covered 4G network of China Mobile. Therefore, it is very difficult for them to pose a threat to China Mobile. The users they can acquire can only come from China Unicom and China Telecom.

In contrast, under the disadvantage of poor network coverage, China Unicom and China Telecom have the lowest user loyalty, which also makes their users the most vulnerable to being taken away by China Broadcasting Network. Previously, during the 4G era, China Unicom and China Telecom gained many users through price wars, which also indicates that their users are more sensitive to prices. If China Broadcasting Network resorts to price wars, these price-sensitive users are also the ones most likely to be lost.

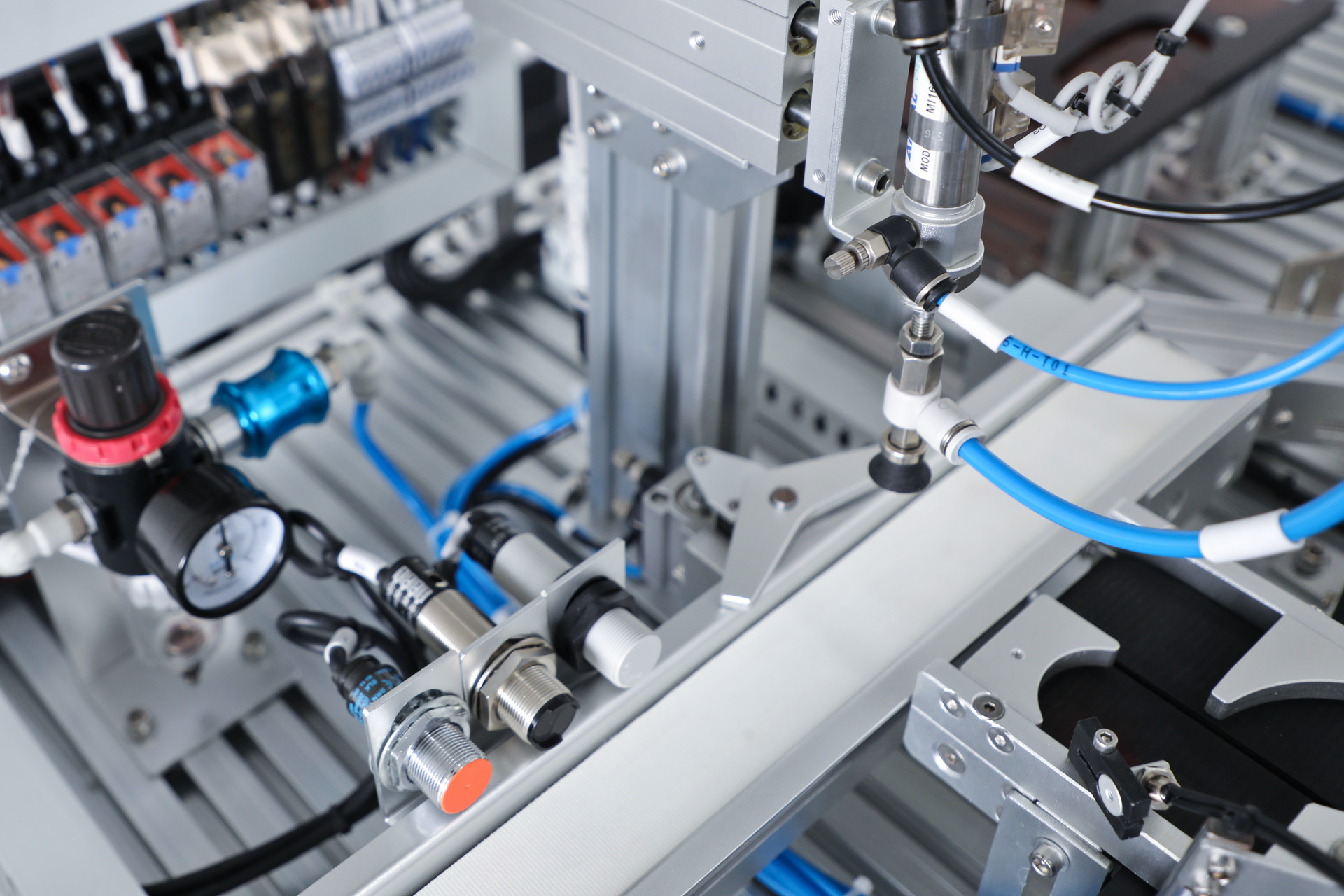

In conclusion, regardless of the perspective, the entry of China Broadcasting Network into the mobile communication market will bring more vitality to the Chinese mobile communication market and further promote the popularization of mobile 5G applications in our country. Our company's 5G public network wireless transmission products have basically completed the upgrade and replacement, and will better meet the diversified needs of users.

-

2025-11-08

2025-11-08 -

How IP Mesh Radios Enable Reliable Emergency Communication Systems

2025-10-30 -

IP Mesh Radios: The Future of Tactical Wireless Networking

2025-10-27 -

What Is Wireless Data Transmission and How Does It Work?

2025-09-26 -

What are the Applications of Ad Hoc Wireless Network?

2025-09-11 -

What Are Point to Point Wireless Bridges Often Used For?

2025-09-05 -

MESH Networking Module Selection Guide: From Dismounted Soldiers to UAV Applications

2025-08-28 -

What Is a Point to Point Wireless Bridge Connection?

2025-08-07